These specially configured A350-1000ULRs are expected to enable the world’s longest commercial flights.

Qantas

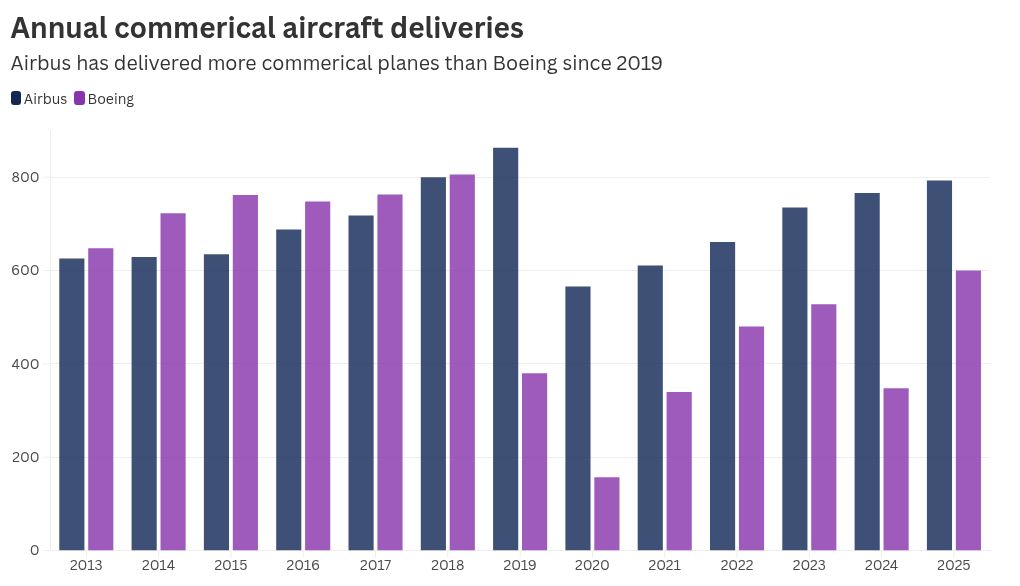

Airbus said Thursday it expects to deliver 870 commercial aircraft in 2026, slightly fewer than the roughly 880 analysts had expected.

It comes as pressure is building for the European planemaker, with U.S. rival Boeing showing signs of recovery after years of crisis which has benefited Airbus, and mounting tensions with key suppliers.

“Global demand for commercial aircraft underpins our ongoing production ramp-up, which we are managing while facing significant Pratt & Whitney engine shortages,” said CEO Guillaume Faury.

Airbus has experienced delays on engines supplied by RTX subsidy Pratt & Whitney, which Faury said was “the single most important topic we are dealing with.”

Shares were last seen down 5.4%, bringing the stock to negative territory so far in 2026.

However, with better clarity on 2026 delivery targets and visibility on the production of its A320 family of planes, a key overhang is removed, said Barclays analyst Milene Kerner.

“Pratt & Whitney’s failure to commit to the number of engines ordered by Airbus is negatively impacting this year’s guidance and the ramp-up trajectory,” Airbus said in a statement. As a consequence, it expects its narrowbody output rate to be between 70 and 75 aircraft a month by the end of 2027, and stabilizing at 75 a month thereafter.

“The development is not surprising given the slower delivery progression observed through 2025,” Kerner said. Airbus had previously targeted 75 aircraft per month in 2027.

Pratt & Whitney parent RTX didn’t immediately respond to a CNBC request for comment.

The sentiment around Airbus has turned markedly more sour since the beginning of the year, UBS analyst Ian Douglas-Pennant said ahead of the full-year report published early Thursday.

Airbus delivered 793 commercial aircraft last year, slightly beating its revised target of 790. The company had cut its earlier goal of 820, citing supplier quality issues involving fuselage panels that affected deliveries of its A320 family.

Barclays analysts described the disruption as a “temporary execution setback” and said the “long-term ramp” remained “intact.”

Airbus has enjoyed a strong momentum over the past few years as rival Boeing has been battling a crisis over design and production issues for its best-selling narrowbody plane, the 737 Max.

Last year was characterized by strong demand for all Airbus’ products, which also include its helicopters and defense and space units, Faury said Thursday.

Boeing is showing signs of recovery

Deliveries are a closely watched metric as planemakers receive the bulk of the payment for an aircraft when it’s handed over to the customer.

Airbus delivered 193 more planes than Boeing in 2025 but Boeing received more orders for the first time since 2018.

That, along with Airbus’ recent quality issues, has led some to see the tide changing for Boeing under the leadership of CEO Kelly Ortberg.

Ortberg, who took the top job in 2024 to lead it out of crisis, was positive about his company’s ability to ramp up production in the near term, after it reported fourth-quarter revenue ahead of Wall Street’s expectations in late January.

Airbus and Boeing’s order backlogs have spiked in recent years due to supply chain issues that arose during the Covid-19 pandemic.

Boeing also secured more deliveries and net orders in the first month of 2026 than Airbus.

Boeing delivered 46 aircraft in January and booked 103 net orders, while Airbus reported only 19 deliveries and 49 net orders over the same period.

Airbus’ January number was notably soft, even accounting for the fact that its deliveries are typically lower at the start of the year.

On a call with analysts on Thursday, Faury said the low January and February deliveries were primarily driven by the issues with the fuselage panels, not by engine delays.

“While January deliveries in any given year is not historically a good indicator of production rates for the year, we view 19 deliveries in Jan-26 as materially weaker than expected vs 25 delivered in Jan-25,” said UBS in a note to clients last week.

“Due to the typically low levels YTD, we can’t deduce much from this trend other than that the expected 2026 delivery profile is likely to be back-end-loaded again,” noted Barclays analysts.

Boeing shares have outperformed Airbus over the past 12 months.

Higher sales and profits

Airbus reported early Thursday adjusted earnings before interest and tax (EBIT) of 2.98 billion euros in the fourth quarter, beating estimates of 2.87 billion, according to a company-provided consensus poll and 17% higher year-on-year.

Revenue rose 5% from last year and came in at 25.98 billion euros in the quarter, slightly below the 26.5 billion euros expected.

For the full year, EBIT totaled 7.13 billion euros, on revenue of 73.4 billion euros.

Looking ahead, Airbus said it expects adjusted EBIT of around 7.5 billion euros and free cash flow before customer financing of about 4.5 billion euros in 2026, alongside its target of around 870 commercial aircraft deliveries.

— CNBC’s Lee Ying Shan contributed to this report.